Get Started Today | Focus On Growth, We'll Handle The Numbers

The Ultimate Guide to Section 179D for Architecture and Engineering Firms

Author: Levi Kedowide, CPA

Request a Callback

If your architecture or engineering firm has designed buildings for government agencies, public schools, or nonprofit organizations, you can claim substantial federal tax deductions for those projects through Section 179D.

These entities cannot use tax deductions themselves, so the tax code allows them to allocate the Section 179D energy-efficiency deduction to the designer instead. For a typical 100,000 square foot government building designed in 2024, the deduction is $565,000—approximately $165,000 in federal tax savings. The deduction can be claimed retroactively for qualifying projects completed as far back as 2006, provided they fall within open tax years.

The challenge is that most A&E firms don't claim this deduction, primarily because their standard accountants aren't familiar with construction industry tax provisions and the claim process requires specific documentation that building owners don't typically provide without being asked.

Additionally, projects must begin construction before June 30, 2026 to qualify—after that date, the provision sunsets and the deduction becomes unavailable.

This guide explains what Section 179D is, how the allocation process works, the documentation requirements, and the specific steps firms need to take to claim the deduction before the deadline.

What Section 179D Actually Provides

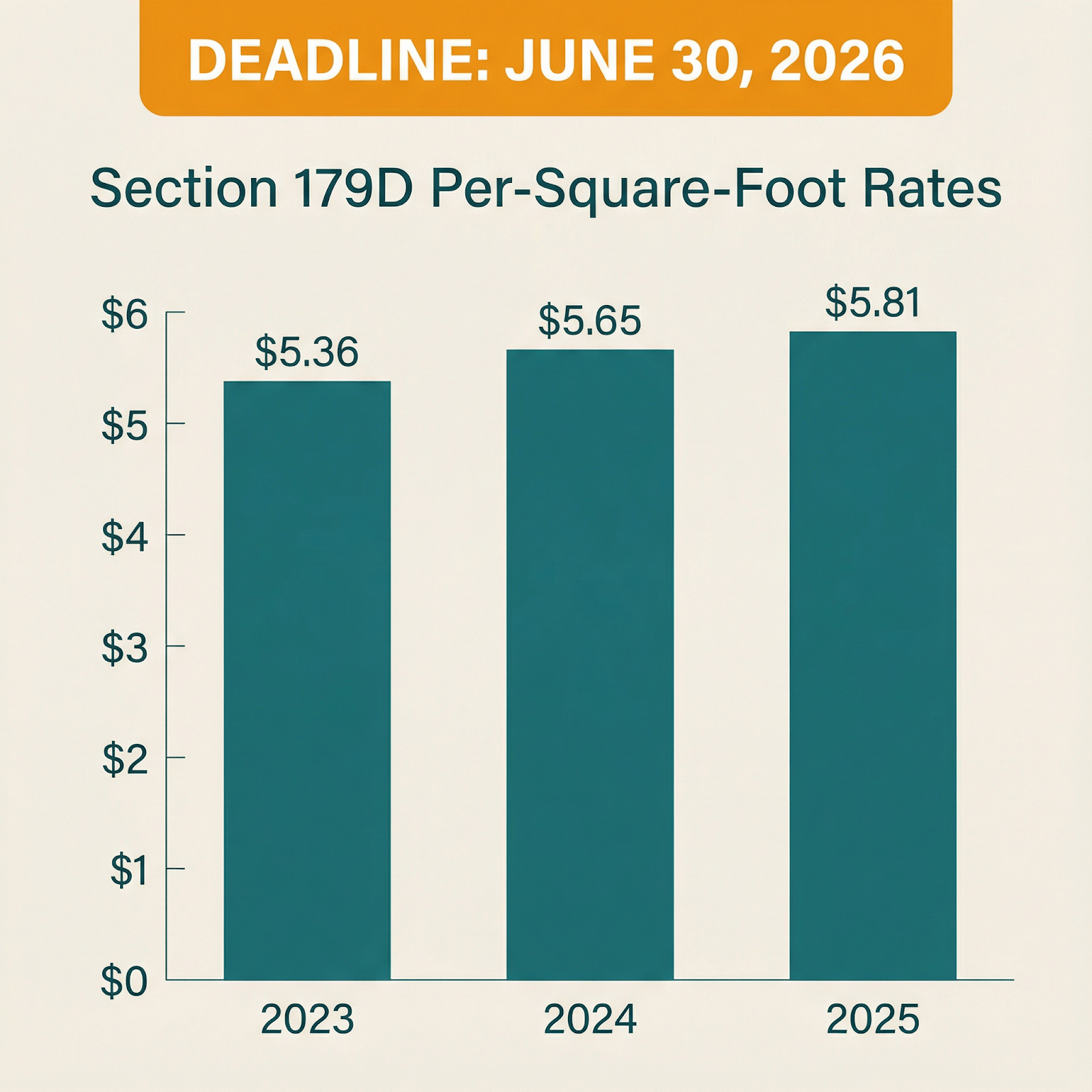

Section 179D is a federal tax deduction for constructing energy-efficient commercial buildings. The deduction amount ranges from $0.54 to $5.81 per square foot, depending on the building's energy performance and the year it was placed in service:

2023 projects: Up to $5.36 per square foot

2024 projects: Up to $5.65 per square foot

2025 projects: Up to $5.81 per square foot

Buildings must achieve specific energy savings thresholds to qualify. Buildings meeting 25% energy savings relative to ASHRAE 90.1 baseline standards qualify for partial deductions (approximately $0.63-$1.45 per square foot depending on the year). Buildings achieving 50% energy savings qualify for the maximum deduction.

The deduction normally goes to the building owner. However, government entities, public schools, and nonprofit organizations are tax-exempt and cannot use tax deductions. The tax code allows these entities to allocate the deduction to the designer instead—the architecture or engineering firm that designed the building's energy-efficient systems.

This allocation mechanism is what makes Section 179D relevant to A&E firms. When you design a government building with qualifying energy performance, the government agency can assign their unusable deduction to your firm through a formal allocation letter.

Why the Deduction Matters for A&E Firms

The financial impact is substantial. A 100,000 square foot government building designed in 2024 that achieves 50% energy savings generates a $565,000 deduction. For a pass-through entity taxed at a 29.6% effective federal rate (accounting for the 20% QBI deduction), that deduction produces $167,240 in tax savings.

Larger projects generate proportionally larger deductions. A 250,000 square foot university building produces a $1.4 million deduction and approximately $415,000 in tax savings. For firms that have designed multiple qualifying government buildings over the past several years, the cumulative deduction can reach seven figures.

The deduction can also be claimed retroactively. Section 179D has existed since 2006, and firms can amend tax returns for any open tax year where they missed eligible projects. Open tax years typically include the three most recent years—currently 2022, 2023, and 2024—though amended returns must be filed within three years of the original return's due date.

The June 30, 2026 Deadline

The Omnibus Business Tax Credit Act established a sunset date for Section 179D. Projects must begin construction before June 30, 2026 to qualify for the deduction. "Begin construction" uses the same definition as other federal tax credit programs—it requires either physical work of a significant nature to have started, or the taxpayer to have incurred at least 5% of the project's total cost.

This deadline creates urgency for two reasons:

First, firms need to identify all qualifying projects placed in service between 2006 and June 30, 2026, request allocation letters from building owners, complete energy modeling certification, and either claim the deduction on current-year returns or amend prior-year returns. Each step in this process takes time—allocation letter requests typically require 6-12 months for government agencies to process.

Second, the deadline for amending prior-year returns is approaching. Returns for 2022 must be amended by April 2026 (three years from the original due date including extensions). This means firms have a narrow window to identify 2022 projects, obtain allocation letters, complete energy certification, and file amended returns.

Section 179D Rates Chart

Why Firms Miss This Deduction

Several factors contribute to firms not claiming Section 179D:

Lack of awareness: Most A&E firms use generalist accounting firms that handle tax compliance across multiple industries. These firms prepare tax returns competently but typically don't specialize in construction industry tax provisions. The standard tax preparation process asks about equipment purchases, retirement contributions, and charitable donations—not about energy-efficient government building designs. Unless the firm or the accountant is specifically aware of Section 179D, it won't appear on the tax return.

The allocation letter requirement: The deduction can only be claimed if the building owner provides a written allocation letter assigning the deduction to the designer. Government agencies don't generate these letters automatically. They have no tax benefit from Section 179D themselves, and most don't have established procedures for tracking which designers might be eligible for allocations. The firm must request the letter, provide template language, and navigate whatever approval process the agency requires. Without knowing the deduction exists, firms don't make these requests.

Energy modeling certification costs: Claiming the deduction requires a third-party energy study completed by a licensed professional engineer or contractor. This study models the building's energy performance against ASHRAE or IECC baseline standards and certifies the percentage energy savings achieved. Energy modeling firms typically charge $5,000-$15,000 per building depending on size and complexity. For smaller projects (under 50,000 square feet), the certification cost can make the deduction less economically viable even if the building technically qualifies.

Project qualification uncertainty: Not every energy-efficient government building qualifies for Section 179D. The building must achieve minimum energy savings thresholds—25% for partial deductions, 50% for maximum deductions. Buildings designed to meet current energy code requirements but not explicitly designed for high energy performance typically achieve 10-20% savings, which doesn't meet the threshold. Firms need to distinguish between projects where energy performance was a design goal versus projects designed to minimum code compliance.

Building Breakdown Visualization

How the Allocation Process Actually Works

Claiming Section 179D requires executing several steps in sequence:

Step 1: Identify Potentially Qualifying Projects

Review all projects placed in service between 2006 and June 30, 2026 where:

The building owner is a federal, state, or local government entity, public school, nonprofit hospital, or public housing authority

The building is a commercial or multifamily residential building

Your firm provided design services for the building envelope, HVAC systems, interior lighting, or hot water systems

The building was designed to achieve energy performance beyond minimum code requirements

Projects to prioritize include LEED-certified buildings, net-zero energy buildings, buildings with aggressive energy budgets in the owner's project requirements, and any building where energy performance was an explicit design criterion.

Step 2: Request Allocation Letters from Building Owners

For each potentially qualifying project, prepare an allocation letter request to submit to the building owner. The request should include:

Project name, address, and placed-in-service date

Description of your firm's design services and role in the building's energy performance

Explanation of Section 179D and why the owner cannot use the deduction themselves

Draft allocation letter language the owner can execute

Contact information for questions

Government agencies typically require 6-12 months to process allocation letter requests. Different agencies have different approval requirements—some need board approval, others need legal review, some have specific forms that must be completed. The firm's primary contact at the agency may not have signature authority, which can extend the timeline.

Submit allocation letter requests as early as possible in the process, even before completing energy modeling, because obtaining the letter is usually the rate-limiting step.

Step 3: Complete Energy Modeling and Certification

Engage a qualified engineering firm to conduct energy modeling for projects where you've received (or expect to receive) allocation letters. The energy modeler needs:

Complete as-built drawings including architectural, mechanical, electrical, and plumbing plans

Equipment schedules and specifications for HVAC systems, lighting fixtures, and building envelope components

Utility data if available to validate model assumptions

The energy modeler runs simulations comparing the as-built building against ASHRAE 90.1 baseline standards (or IECC for residential buildings) and calculates the percentage energy savings. The modeler then provides a signed certification statement meeting IRS requirements.

This certification must be prepared by a licensed professional engineer or contractor and must include specific disclosures about the certifier's independence and qualifications. The certification is a required attachment to the tax return.

Step 4: Claim the Deduction on Tax Returns

For current-year deductions, report the Section 179D deduction on Form 4562 (Depreciation and Amortization) attached to the firm's tax return. Include the energy certification and allocation letter as supporting documentation.

For retroactive claims on prior-year projects, file amended tax returns (Form 1040-X for partners in partnerships or S corporation shareholders, Form 1120-S for S corporations filing entity-level returns). Amended returns must be filed within three years of the original return's due date including extensions.

Step 5: Maintain Required Documentation

Keep copies of all supporting documentation:

Allocation letters from building owners

Energy modeling certifications

Building plans and specifications

Evidence of placed-in-service dates

Correspondence with building owners and energy modelers

The IRS can audit returns for three years after filing (six years if there's a substantial understatement of income). Section 179D deductions can be selected for examination, and the IRS will request the allocation letter and energy certification. Without these documents, the deduction will be disallowed.

Common Documentation Issues That Cause Disallowances

Several documentation problems can cause the IRS to disallow Section 179D deductions:

Defective allocation letters: Allocation letters must meet specific IRS requirements. Common problems include:

Letter not signed by an authorized representative of the building owner

Letter missing required project details (building square footage, address, placed-in-service date)

Letter that allocates the deduction to "the architecture firm" without specifying the exact legal entity name as it appears on the tax return

Letter dated after the tax return was filed

Inadequate energy certifications: Energy certifications must be signed by a licensed professional engineer or contractor and must reference the specific ASHRAE or IECC baseline standard used. Certifications missing required disclosures about the certifier's qualifications or independence don't meet IRS requirements.

Building doesn't actually meet energy thresholds: Energy modeling sometimes reveals that buildings assumed to be energy-efficient don't actually achieve the required 25% or 50% savings thresholds. This can happen when LEED certification focused on water efficiency or materials selection rather than energy performance, when HVAC contractors made field substitutions that reduced efficiency, or when actual building operations differ from design assumptions.

What Firms Should Do Before the Deadline

The June 2026 deadline requires firms to start the claim process now. Here's a recommended timeline:

Next 30 days:

Conduct a project audit to identify all government building projects placed in service since 2006. Pull project lists from your project management system and filter for projects where the building owner was a government entity and your firm provided design services for building systems (not just interior design or site planning).

Focus initially on projects over 50,000 square feet and projects where energy performance was an explicit design goal, as these are most likely to qualify and generate meaningful deductions.

30-60 days:

Submit allocation letter requests to building owners for your highest-priority projects. Don't wait for energy modeling results—allocation letters take 6-12 months to obtain, and you need to start the process immediately to meet the June 2026 deadline.

60-90 days:

Engage a Section 179D specialist or engineering firm to conduct preliminary energy assessments for high-priority projects. A preliminary assessment (typically $2,000-$5,000 per project) determines whether full energy modeling is warranted and estimates the likely deduction amount.

For projects placed in service in 2022, 2023, and 2024, calculate the potential benefit of amending returns and determine if the amendments are economically viable given energy modeling costs.

90+ days:

Commission full energy modeling and certification for projects that pass preliminary assessment and have allocation letters in process. Energy modeling typically requires 6-8 weeks once the modeler has complete documentation.

Prepare amended returns for 2022-2024 if retroactive deductions are available and the tax benefit exceeds the cost of obtaining energy certifications.

Understanding the Economics of Section 179D Claims

Not every qualifying project makes economic sense to claim. The decision depends on:

Project size and deduction amount: Larger buildings generate larger deductions. A 200,000 square foot building produces a $1.13 million deduction (at 2024 rates), worth approximately $335,000 in tax savings. A 30,000 square foot building produces a $169,500 deduction, worth approximately $50,000 in tax savings.

Energy modeling costs: If energy modeling costs $10,000 and the tax savings is $50,000, the claim makes sense. If energy modeling costs $10,000 and the tax savings is $15,000, it may not be worth the effort unless you're already modeling other projects and can achieve economies of scale.

Likelihood of qualification: Buildings explicitly designed for high energy performance (LEED Gold or Platinum, net-zero energy, aggressive energy budgets) are more likely to achieve the required energy savings thresholds. Buildings designed to meet code but without specific energy performance goals may not qualify even after spending money on energy modeling.

Allocation letter probability: Some government agencies are responsive to allocation letter requests and have established procedures. Others are difficult to work with or have never issued allocation letters before. The likelihood of obtaining a letter affects whether it makes sense to invest in energy modeling.

A reasonable approach is to start with your largest, most energy-efficient government projects where you have good relationships with the building owner. These projects have the highest probability of successful claims and the best return on the cost of energy modeling.

After the June 2026 Deadline

Projects that don't begin construction before June 30, 2026 cannot claim Section 179D deductions regardless of when design work was completed or how energy-efficient the building is. The sunset is absolute.

Firms that discover Section 179D after the deadline and realize they designed qualifying projects before June 2026 cannot claim the deduction retroactively after the sunset date. The three-year window for amending returns also closes—2022 returns must be amended by April 2026, 2023 returns by April 2027, and so on.

This means the opportunity to claim Section 179D for historical projects is time-limited. Firms need to identify eligible projects, obtain allocation letters, complete energy modeling, and file current or amended returns while both the June 2026 sunset and the three-year amendment windows are still open.

The deduction represents tax savings on work that's already been completed. Buildings have been designed, construction has been finished, and government agencies would likely provide allocation letters if asked. The only question is whether firms identify the opportunity and complete the claim process before the deadlines close.

Sunbridge Advisory

Your dedicated finance and tax team

DISCLAIMER OF TAX ADVICE: Any discussion contained herein cannot be considered to be tax advice. Actual tax advice would require a detailed and careful analysis of the facts and applicable law, which we expect would be time consuming and costly. We have not made and have not been asked to make that type of analysis in connection with any advice given in this e-mail/newsletter. As a result, we are required to advise you that any Federal tax advice rendered in this e-mail is not intended or written to be used and cannot be used for the purpose of avoiding penalties that may be imposed by the IRS. In the event you would like us to perform the type of analysis that is necessary for us to provide an opinion, that does not require the above disclaimer, as always, please feel free to contact us

Ready to take control of your finances?

Contact Sunbridge Advisory to schedule a free consultation and take control of your Finances!